Energy Trading Platforms on Blockchain: Revolutionizing Decentralized Energy Markets

Energy Trading Platforms on Blockchain: Revolutionizing Decentralized Energy Markets

The Emergence of Blockchain in Energy Trading

Blockchain technology is fundamentally reshaping the landscape of energy trading by introducing unprecedented levels of transparency, efficiency, and decentralization. Traditional energy markets have long been characterized by complex intermediaries, high transaction costs, and limited accessibility. Blockchain platforms are disrupting this paradigm by enabling direct peer-to-peer energy transactions, creating more dynamic and sustainable trading ecosystems.

Technical Architecture of Blockchain Energy Trading Platforms

Blockchain energy trading platforms leverage smart contract technology to facilitate secure, automated transactions between energy producers and consumers. These platforms typically utilize distributed ledger technology (DLT) to record and validate energy generation, consumption, and trading activities. By implementing cryptographic protocols, these systems ensure data integrity, prevent double-spending, and provide immutable transaction records across multiple jurisdictions.

Top Blockchain Energy Trading Protocols in 2024

| Protocol | Jurisdiction | Key Features | Transaction Volume (2023) |

|---|---|---|---|

| Power Ledger (Australia) | Australia | P2P Renewable Energy Trading | $45M |

| WePower | Estonia | Green Energy Tokenization | $32M |

| Grid+ | USA | Decentralized Energy Marketplace | $28M |

| Energy Web Chain | Switzerland | Enterprise Blockchain Solution | $55M |

Regulatory Landscape and Compliance Frameworks

The legal framework surrounding blockchain energy trading varies significantly across international jurisdictions. In the United States, regulatory bodies like FERC and state-level public utility commissions are developing comprehensive guidelines for blockchain-based energy platforms. European jurisdictions such as Switzerland and Liechtenstein have implemented more progressive regulatory environments, actively encouraging blockchain innovation in energy markets.

The British Virgin Islands and Cayman Islands have emerged as attractive jurisdictions for blockchain energy trading platforms due to their flexible regulatory approach and robust legal infrastructure. These offshore financial centers provide an environment conducive to technological experimentation and investment.

Market Dynamics and Economic Implications

Blockchain energy trading platforms are creating new economic models that democratize energy production and consumption. By enabling micro-transactions and reducing intermediary costs, these platforms lower barriers to entry for renewable energy producers. Small-scale solar and wind energy generators can now directly sell excess electricity to consumers, creating more resilient and distributed energy ecosystems.

Global Market Size Projection

According to recent market research, the blockchain energy trading market is projected to reach $3.5 billion by 2027, with a compound annual growth rate (CAGR) of 35.2%. This rapid expansion reflects increasing investor interest and technological maturation in the sector.

Technical Challenges and Innovation Vectors

Despite significant advancements, blockchain energy trading platforms face technical challenges such as scalability, interoperability, and real-time energy tracking. Advanced solutions involving artificial intelligence, Internet of Things (IoT) sensors, and machine learning algorithms are being developed to address these complexities.

RWA.codes: Enabling Blockchain Energy Trading Solutions

At RWA.codes, we specialize in developing sophisticated blockchain infrastructure for energy trading platforms. Our comprehensive services include:

- Custom smart contract development

- Regulatory compliance consulting

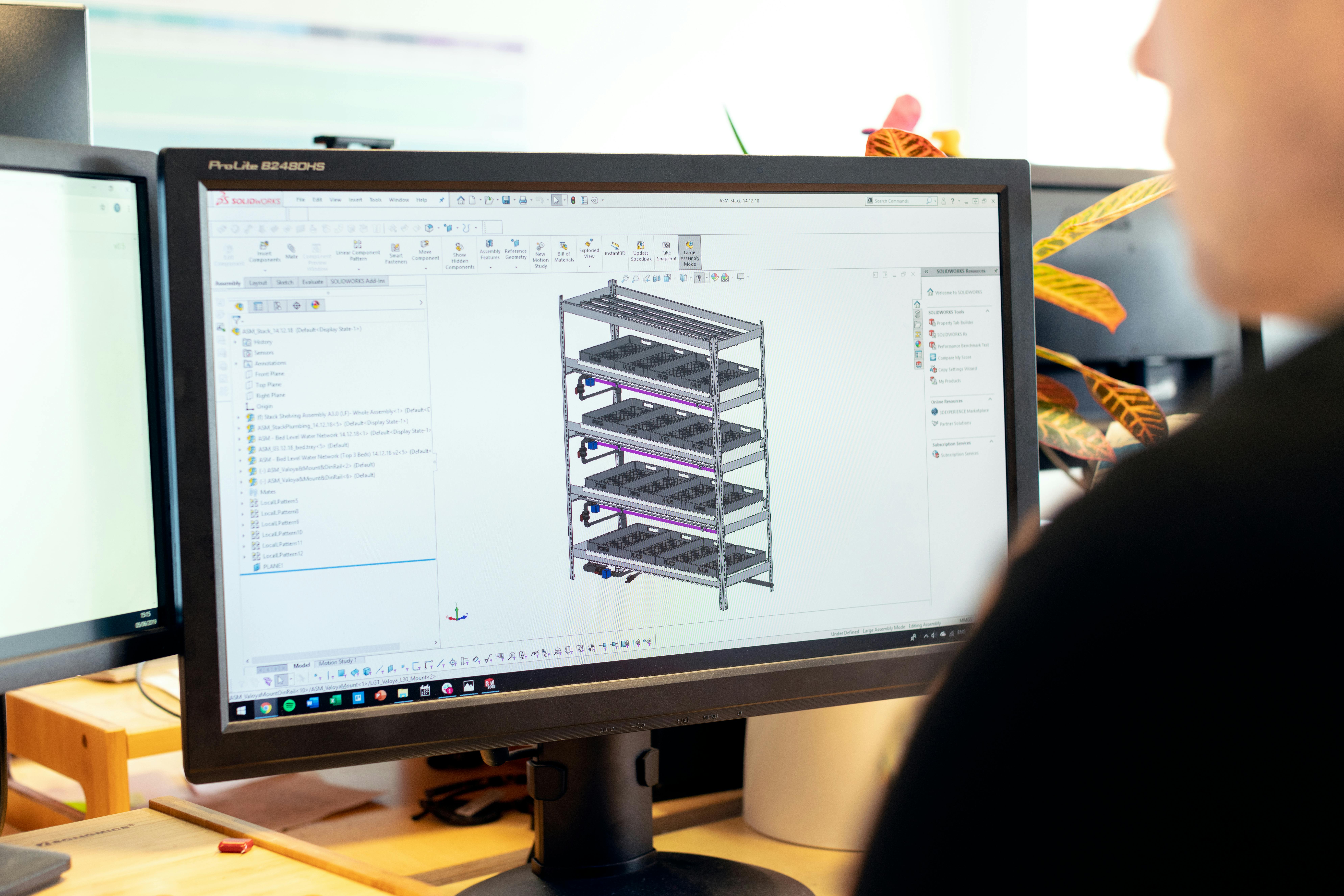

- Platform architecture design

- Security auditing and optimization

- Integration of advanced cryptographic protocols

Our multidisciplinary team combines deep technical expertise with legal and financial acumen, enabling us to deliver cutting-edge blockchain solutions tailored to the evolving energy trading landscape.